Investment Outlook December 2023

November turned out to be a remarkable month. The majority of assets experienced an upward trend, including highly risky assets like cryptocurrencies. The primary reason behind this is the market’s collective opinion that interest rates have peaked. This belief, revolving around the likelihood of a favorable soft landing, has generated fresh enthusiasm for stocks. At the start of the year, few investors could have anticipated the S&P 500 climbing nearly 20%; nevertheless, that’s the reality we find ourselves in now. Together with the assumption of a rate peak and other factors such as a slowdown in inflation, and rising profits, improved market sentiment and propelled stock values upwards this month.

Considering the momentum and seasonality working in favor, stocks might continue their upward trend until year-end, even though the traditional Christmas rally appears to have occurred earlier in November this year. Investors rightly note that the equally weighted S&P 500 has barely shown gains for this year, and the surge has been predominantly fueled by the ¨Magnificent Seven¨ stocks. However, this month, the rally has broadened, uplifting previously lagging stocks. The extent to which gains for next year have been pulled forward remains uncertain, but it’s plausible that overly positive news might already be factored into current prices. There’s still a reasonable chance that the Fed might maintain tight monetary policy next year, inflation could persist at elevated levels, or high interest rates might trigger problems in the economy. Since any kind of market timing is difficult, especially in the wake of recession, which is foreseen in the first half of 2024, staying positioned defensively is the base case. We are leaning towards a low-risk portfolio strategy, with a lower allocation to equities and credit and higher allocation to government bonds.

BENDURA Investment Policy

| very unattraktive | unattraktive | neutral | attraktive | very attraktive | |

|---|---|---|---|---|---|

| g | g | g | g | g | g |

| Liquidity | b | ||||

| g | g | g | g | g | g |

| Fixed Income | b | ||||

| Government | b | ||||

| Corporate | b | ||||

| High Yield | b | ||||

| Emerging Markets | b | ||||

| Duration | b | ||||

| g | g | g | g | g | g |

| Equities | d | ||||

| United States | d | ||||

| Eurozone | d | ||||

| United Kingdom | d | ||||

| Switzerland | d | ||||

| Japan | d | ||||

| Emerging Markets | d | ||||

| g | g | g | g | g | g |

| Foreign Exchange Rates | |||||

| USD | r | ||||

| EUR | r | ||||

| CHF | r | ||||

| EM Currencies | r |

The terms attractive / unattractive describe the return potential of the various asset classes. An asset class is considered attractive if its expected return is above the local cash rate. It is considered unattractive if the expected return is negative. Very attractive / very unattractive denote the highest conviction views of the BENDURA Investment Committee. The time horizon for these views is 3-6 months.

Global Economy

On a global scale, stocks concluded their most significant monthly surge in three years. The MSCI All-Country World index rose by more than 9% throughout November, marking its best month since November 2020, when news of a Covid-19 vaccine breakthrough sent stocks soaring. Both US and European markets recorded substantial single-digit gains, with the Nasdaq surging by almost 11%, pushing its year-to-date gains beyond 35%. The S&P 500 surged by 9%, approaching its 2021 year-end records by a margin of only 4-5%.

Economic activity in the United States has slowed in recent weeks, especially as consumers have scaled back their discretionary spending. This trend is concerning given that it’s happening just before the holiday season, a period typically associated with increased consumer spending. Moreover, the overall economic outlook has become less optimistic, reflecting this slowdown. There’s been a noticeable easing in labor demand, with most districts reporting minimal to modest employment gains. Additionally, reports suggest a reduction in wage pressures across many districts. This shift in the economic landscape indicates that consumers are becoming more price-sensitive, particularly evident in their spending on discretionary and durable goods. This change in consumer behavior underscores a cautious consumer environment influenced by broader economic factors.

In Europe markets showed a significant resurgence in November, largely fueled by a rally in rate-sensitive sectors and the evolving perception of central bank rate policies nearing their peak, prompting speculation about potential rate cuts in the future. There’s a notable shift unfolding across the euro area, marking a significant reversal in roles from the fiscal crises witnessed just over a decade ago, which nearly destabilized the single currency. Initially, it was the so-called periphery countries—Portugal, Italy, Ireland, Greece, and Spain—drawing investor scrutiny due to substantial debts. However, the scenario has now changed. Core nations like Germany and France find themselves increasingly under scrutiny, compelled to justify their budgetary challenges and fiscal strategies that are approaching the limits set by the European Union.

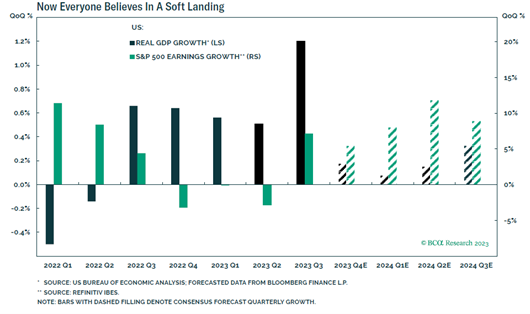

Chart 1: Markets now calculate for the Soft Landing. Source: BCA Research, www.bcaresearch.com

Equities

US equities experienced a notable uptick this month, marking a shift from three consecutive months of declines for the S&P 500 and Nasdaq. Both indices recorded their most significant monthly gains since July 2022 in November. Specifically, the S&P 500 surged by 8.92%, while the tech-heavy Nasdaq soared by approximately 10.70%, pushing its year-to-date gains beyond 35%. Furthermore, small and mid-cap stocks (SMID) also joined the rally, with the Russell 2000 index climbing by 8.83% and finally moving into positive territory for the year, although still significantly underperforming large-cap stocks. An intriguing aspect of November’s market rally is the resurgence of underperforming sectors from earlier in the year. Various segments of the stock market that had faced declines are rebounding, contributing to the surge that propelled the S&P 500. Notably, sectors affected by concerns regarding higher interest rates and potential recession have shown significant recovery. Cyclical stocks, typically moving in line with economic trends, are gaining momentum, buoyed by hopes for a soft economic landing.

In November, European equity markets demonstrated a sharp upturn, reversing a trend of three consecutive months of subdued performance. Sectors sensitive to interest rates, notably real estate and technology, were among the top performers. This surge coincided with a substantial rally in bonds, driven by the perception that central bank rate hiking cycles had reached their peak, shifting focus toward the timing of potential rate cuts.

The decline in net foreign inflows to China’s stock market intensified notably in recent months, with traders and analysts attributing this trend to the perceived lack of robust policy support from Chinese leaders. The absence of assertive policy measures from Chinese authorities led global institutional investors to refrain from making significant purchases. Following a peak of Rmb235 billion ($32.6 billion) in early August, propelled by government assurances of more substantial economic policy backing, net foreign inflows to China’s stock market have plummeted by 77% to just Rmb54.7 billion. This substantial decline indicates a notable loss of confidence among global investors in China’s equity market and the underlying economic landscape, leading to a significant reduction in foreign investment inflows compared to earlier expectations.

Fixed Income

Key focus this month centered on interest rates, as the US 10-year yield decreased by around 60 basis points, propelling stock market gains. The notable surge in November encouraged investors to take on more risk and anticipate a smooth economic slowdown instead of full-scale recession. The US bonds experienced robust growth, marking their most substantial monthly performance in nearly four decades. This surge was driven by escalating optimism surrounding potential interest rate reductions by the Federal Reserve in the coming year, leading to a remarkable recovery from the earlier decline experienced in early autumn. The Bloomberg US Aggregate Bond index, a widely observed metric capturing total returns on US fixed income, surged by 5% in November, showcasing its most impressive performance since 1985. Notably, the uptrend in US government debt prices influenced similar movements in global government bonds.

Similarly, in Europe, bonds experienced an upsurge. The German Bund saw a decline of 36 basis points to 2.44%, Italian BTPs dropped by 50 basis points to 4.23%, and Gilts in the UK fell by 33 basis points to 4.20%. Overall, the fixed income market witnessed a substantial rally, both in the US and internationally, primarily propelled by heightened expectations of future Federal Reserve interest rate cuts. Regarding European Central Bank (ECB) interest-rate cuts, traders are increasingly anticipating an earlier initiation of rate reductions next year, despite cautionary statements from policymakers emphasizing the likelihood of sustained elevated borrowing costs. Market indicators, including swaps tied to the ECB’s meeting dates, now fully price in a quarter-point decrease to the ECB’s deposit rate by April, a considerable shift from expectations just over a month ago when the first rate cut was projected for June.

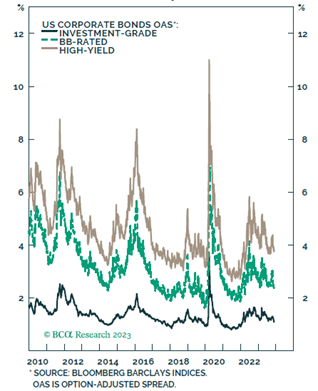

We keep our opinion in fixed income area unchanged. We suggest underweighting the credit due to rising defaults caused by higher interest rates and prefer government bonds as a good hedge against recession risks and a little downside given the fact that interest rates have more possibility to fall than to rise further.

Chart 2: Credit Is Not Attractively Priced. Source: BCA Research, www.bcaresearch.com

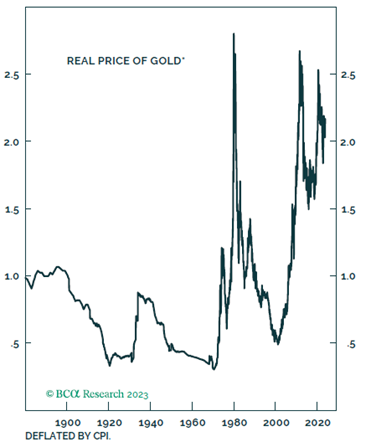

Commodities and Currencies

Soft economic data emerging from the US has further reinforced the belief among investors that interest rates are unlikely to experience any additional increases throughout the remainder of this year. Moreover, there’s an increasing anticipation that rates might be reduced in the upcoming year. These factors have contributed significantly to the bullish sentiment surrounding gold, prompting investors to seek the asset as a hedge against potential market volatility and economic uncertainties.

Uranium, a crucial element for zero-carbon reactors and nuclear weaponry, has notably outperformed almost every component of the Bloomberg Commodity Index this year, exhibiting a 68% surge—second only to orange juice. Despite the setbacks faced by nuclear power, particularly the significant shutdowns in Europe, notably in Germany, the rise in uranium prices from around $30 per pound in the summer of 2021 to over $80 today stands as the highest since 2008.

Chart 3: The US Dollar remains very overvalued. Source: BCA Research, www.bcaresearch.com