Investment Outlook February 2024

In January stocks in the US and Europe continued their way up, marking the third consecutive month of gains and achieving several record highs. The S&P 500 and Nasdaq 100 in the US, as well as the DAX and CAC 40 in Europe, reached new peaks, largely driven by increasing expectations of interest rate cuts on both sides of the Atlantic this year. Despite these milestones, there was a cautious tone among investors, as the rapid pace of the rally since the end of last year raised concerns, and some viewed the record highs with skepticism.

The resemblance between the first month of 2024 and 2023 is striking. The dominance of the “Magnificent 7” stocks (excluding TSLA) in outperforming the broader market continues, while other segments struggle. Investor focus remains fixated on monitoring and interpreting the actions of central banks, particularly the Federal Reserve. On a positive note, historical market trends suggest that a rise in the S&P 500 during January is often followed by strong performance for the remainder of the year, with positive returns occurring in the majority of months. Conversely, a decline in January tends to lead to lower average returns for the rest of the year, with positive months occurring less frequently. However, since any kind of market timing is difficult, especially in the wake of recession, which is still possible during 2024, staying positioned defensively is the base case. We are leaning towards a low-risk portfolio strategy, with a lower allocation to equities and credit and higher allocation to government bonds.

BENDURA Investment Policy

| very unattraktive | unattraktive | neutral | attraktive | very attraktive | |

|---|---|---|---|---|---|

| g | g | g | g | g | g |

| Liquidity | b | ||||

| g | g | g | g | g | g |

| Fixed Income | b | ||||

| Government | b | ||||

| Corporate | b | ||||

| High Yield | b | ||||

| Emerging Markets | b | ||||

| Duration | b | ||||

| g | g | g | g | g | g |

| Equities | d | ||||

| United States | d | ||||

| Eurozone | d | ||||

| United Kingdom | d | ||||

| Switzerland | d | ||||

| Japan | d | ||||

| Emerging Markets | d | ||||

| g | g | g | g | g | g |

| Foreign Exchange Rates | |||||

| USD | r | ||||

| EUR | r | ||||

| CHF | r | ||||

| EM Currencies | r |

The terms attractive / unattractive describe the return potential of the various asset classes. An asset class is considered attractive if its expected return is above the local cash rate. It is considered unattractive if the expected return is negative. Very attractive / very unattractive denote the highest conviction views of the BENDURA Investment Committee. The time horizon for these views is 3-6 months.

Global Economy

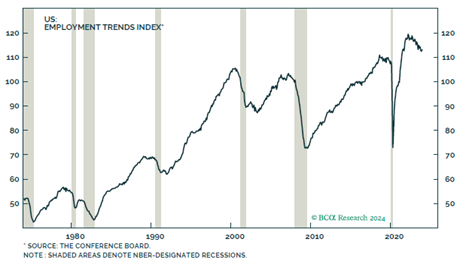

The US economy still has several buffers that help delay the impact of higher interest rates, including the accumulation of household savings during the pandemic, the prevalence of 30-year fixed-rate mortgages, and the significant corporate borrowing at low rates in 2020. However, signs of strain from higher rates are becoming evident. Bankruptcies and corporate defaults have increased notably, and cracks are emerging in the labor market. Various indicators such as voluntary quits, hours worked, temporary employment, and components of the manufacturing and services ISMs are indicating weakness. The Conference Board’s Employment Trends Index, which takes into consideration leading indicators, has deteriorated in a manner typically observed before recessions. Furthermore, the decline in job openings is not limited to the US. Data from large job portals such as Indeed also show a similar trend across major developed economies, particularly notable in Canada and the UK.

Additionally, the economic situation outside the US appears more unstable. Eurozone production and consumption are experiencing sharp declines. Although China’s recent substantial underperformance and low valuation may tempt some investors to “bottom-fish,” caution must be taken into consideration. Confidence in China remains low, and while real GDP growth may have surpassed government targets last year, nominal GDP, which is more pertinent for stocks, remains subdued. Property prices have only begun to decline, and considering the high real bond yield, valuations in China are not particularly cheap, with China’s equity risk premium comparable to that of India, often considered an expensive market.

China’s economy expanded by 5.2% last year, a notable improvement from the 3% growth seen in 2022, but still significantly below pre-pandemic rates exceeding 6%. Without significant policy adjustments, 2024 is likely to see a continuation of this subdued growth trajectory. Real growth in urban disposable income was just 4.8% last year, marking the lowest level since at least 2002, excluding the pandemic years of 2020 and 2022. Despite some signs of stabilization in investment outside of the property sector, the overall outlook remains subdued. Until the property market, services sector employment, and income growth show more substantial improvement, China’s economic growth will likely continue at a sluggish pace compared to pre-pandemic levels.

However, the fear of a recession has been largely erased from the minds and portfolios of most investors, replaced by a strong belief in a soft landing scenario. Even for those who do not foresee an imminent economic slowdown, there are numerous factors, including upcoming elections, that indicate the possibility of increased turbulence in the markets. These factors highlight the importance of maintaining a cautious approach and being prepared for potential shifts in market sentiment.

Chart 1: The labor market is showing cracks. Source: BCA Research, www.bcaresearch.com

Equities

The S&P 500 has surged back to record levels for the first time in two years, with January witnessing positive performance in US equities. Both the Dow and S&P reached fresh record highs during the month, a feat not achieved since early 2022. However, small-cap stocks, represented by the Russell 2000, experienced a pullback, declining almost 4% in January. The S&P 500 advanced 1.59% and the Dow gained 1.22%, while the tech-heavy Nasdaq lagged slightly, finishing the month up 1.02%. Several “Magnificent Seven” stocks, including NVDA which surged 24.2%, were notable gainers. The equal weighted S&P 500, which highlights the top-heaviness of the index, declined by 0.91. While the S&P 500 index hit an all-time high last month, it’s noteworthy that Information Technology is the only sector among the index’s 11 sectors to achieve this milestone. The remaining sectors are trading, on average, 15% below their all-time highs. This contrasts with the broader market rally observed two years ago when several sectors, including industrials, financials, consumer staples, real estate, healthcare, utilities, and materials, joined technology in reaching new highs in the weeks preceding the S&P 500’s January 2022 record.

European equity markets extended their gains for the third consecutive month, with the STOXX 600 index hovering around 1.8% below its all-time high reached in December 2021, near 495. However, the FTSE 100 underperformed, experiencing losses of 1.3% due to its significant exposure to the struggling mining and energy sectors. Spain’s Ibex also underperformed, with a loss of -0.24%.

Conversely, the French CAC 40 index ended the month at a new all-time high, gaining 1.51%, boosted by positive performance from luxury goods companies. Equity markets in general continued to benefit from expectations of central bank policy easing. Although there was some resistance from ECB officials, President Lagarde hinted at the possibility of a rate cut in the spring if economic data supports it. Attention also turned to tensions in the Middle East, particularly with attacks on vital shipping lanes in the Red Sea. These developments could impact European industrials and potentially contribute to a resurgence in price pressures.

Chinese individual investors are increasingly turning their attention to Japanese shares as their domestic market faces challenges. Foreign investors who previously allocated significant funds to China are also seeking alternative international investment opportunities. Additionally, many Chinese domestic investors are looking to diversify their portfolios and are considering Japan as an attractive option due to its lower valuation compared to the US and potentially lower political and regulatory risks. The Nikkei 225 index in Japan has already surged by 9% since the beginning of the year and is now just 6% below its record high from 1989. In contrast, China’s CSI 300 index has declined by 6%, while Hong Kong’s Hang Seng Index, which includes tech giants like Alibaba and Tencent, has performed even worse, losing 12% in 2024 so far. This divergence in performance has contributed to the growing appeal of Japanese stocks among Chinese investors seeking better returns and stability amidst uncertainties in their domestic market.

Fixed Income

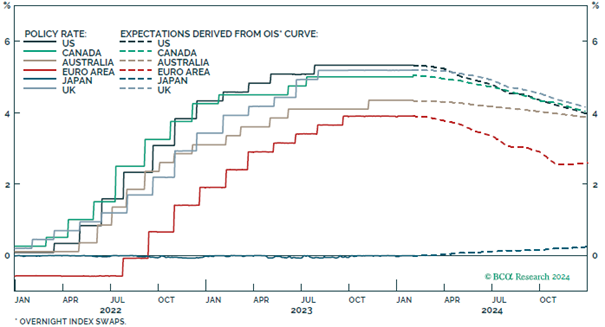

There have been notable developments on the monetary policy front in the US recently. Towards the end of the year, futures-based indicators indicated that investors were anticipating a rate cut in March, with probabilities exceeding 70%. However, remarks from Fed officials questioned the need for rapid rate cuts and shifted market expectations to a more balanced stance, with almost no likelihood of a March cut. For this reason, treasuries were mostly weaker with the yield curve steepening.

The recent update from the European Central Bank (ECB) was a main point in the realm of central bank policy decisions. While the ECB aimed to keep its policy unchanged and attempted to temper expectations for rate cuts, attention was drawn to remarks indicating a potential shift towards policy easing. President Lagarde mentioned that a rate cut is unlikely until the summer and acknowledged positive developments in labor markets but mentioned a willingness to also act before April if necessary. Additionally, she emphasized the importance of monitoring more timely data and highlighted the significance of the March forecasts. Market reaction reflected heightened expectations for policy easing, with up to a 90% chance priced in for a rate cut in April and expectations of 50 basis points worth of easing by June. Lagarde’s remarks on elevated domestic price pressures further fueled speculation of impending monetary stimulus measures from the ECB. These developments underscore the cautious stance of the ECB and its readiness to respond to evolving economic conditions.

Chart 2: Central banks everywhere are expected to cut rates aggressively.

BCA Research, www.bcaresearch.com

Commodities and Currencies

In recent weeks oil prices have experienced a rally, with spot Brent reaching $83 a barrel, up from a low of $73 in December. However, this upward movement is primarily driven by market concerns about potential disruptions to supply, such as an escalation of conflicts in the Middle East, rather than reflecting stronger demand dynamics. It’s important to notice that oil demand is cyclical, typically declining during periods of economic recession. As a result, our stance on oil remains neutral, as the possibility of geopolitical disruptions offsets the potential impact of economic downturns on demand.

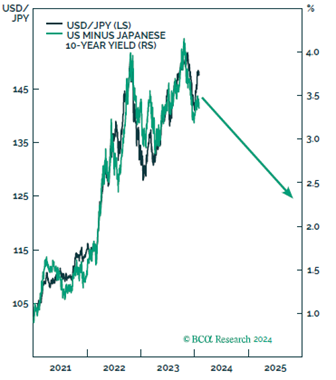

The dollar is currently deemed to be significantly overvalued, but it is anticipated to appreciate modestly against more cyclically sensitive currencies such as the euro if we are about to face a recession this year. However, the yen remains the preferred currency choice. It is notably undervalued, currently trading at 148 to the dollar compared to an IMF estimate of purchasing power parity (PPP) at 91. Interest rate differentials favoring the yen are also expected to strengthen

Chart 3: JPY should rise as rate differentials shrink. BCA Research, www.bcaresearch.com