Investment Outlook January 2024

Year 2023 defied the pessimism that loomed through the whole year. Despite initial forecasts of a US recession and global downturn by numerous experts, the year witnessed a remarkable surge in stock markets. This year saw challenges such as aggressive rate hikes by the FED and ECB, banking crises impacting several institutions and geopolitical tensions in the Middle East and Eastern Europe, however stocks continued their way up. Notably, even as the 10-year yield hit 5% for the first time in 16 years, the fear of higher bonds yields and falling prices did not realize. It led to the rally with S&P 500 finishing the year up by 24%, nearly reaching its January 2022 record. The Nasdaq Composite witnessed a staggering 43% increase, largely related to the AI hype and big technology stocks, marking its best performance since 2020.

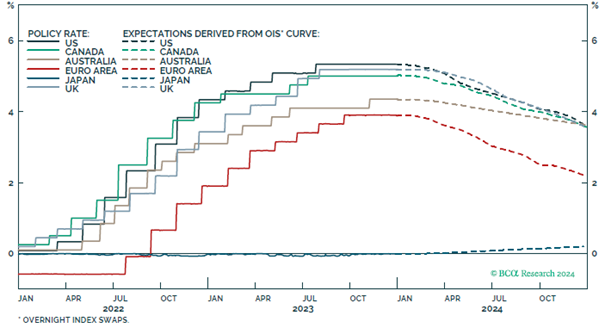

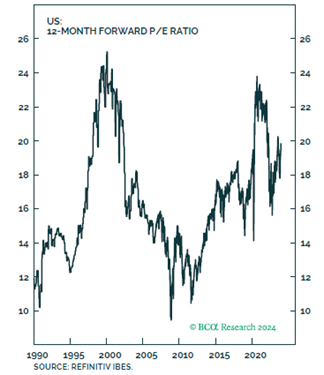

Looking forward, there are glimpses of hope amidst lingering risks. A majority of investors, recently surveyed by Bank of America, now anticipate a softer economic landing—a significant shift from the beginning of the year. The forceful actions of central banks in hiking rates are gradually paving the way for expectations of upcoming rate cuts. As of now – not due to economic distress but rather as part of the normalization of monetary policy. The market has got excited by the prospect that the Fed will cut rates rapidly this year. However, the accumulative effects of tight monetary policy in the last years are still on track to trigger the recession. Since any kind of market timing is difficult, especially in the wake of recession, which is foreseen during 2024, staying positioned defensively is the base case. We are leaning towards a low-risk portfolio strategy, with a lower allocation to equities and credit and higher allocation to government bonds.

BENDURA Investment Policy

| very unattraktive | unattraktive | neutral | attraktive | very attraktive | |

|---|---|---|---|---|---|

| g | g | g | g | g | g |

| Liquidity | b | ||||

| g | g | g | g | g | g |

| Fixed Income | b | ||||

| Government | b | ||||

| Corporate | b | ||||

| High Yield | b | ||||

| Emerging Markets | b | ||||

| Duration | b | ||||

| g | g | g | g | g | g |

| Equities | d | ||||

| United States | d | ||||

| Eurozone | d | ||||

| United Kingdom | d | ||||

| Switzerland | d | ||||

| Japan | d | ||||

| Emerging Markets | d | ||||

| g | g | g | g | g | g |

| Foreign Exchange Rates | |||||

| USD | r | ||||

| EUR | r | ||||

| CHF | r | ||||

| EM Currencies | r |

The terms attractive / unattractive describe the return potential of the various asset classes. An asset class is considered attractive if its expected return is above the local cash rate. It is considered unattractive if the expected return is negative. Very attractive / very unattractive denote the highest conviction views of the BENDURA Investment Committee. The time horizon for these views is 3-6 months.

Global Economy

Globally, stocks saw their strongest performance since 2019, driven by a rapid two-month rally which was fueled by the belief that major central banks had concluded their tightening cycles. The MSCI World index surged by 16% since late October and closed the year up 22%, its best showing in four years. This surge was predominantly led by the S&P 500, which gained 14% since October and closed the year up by 24%, nearly touching its all-time high. Similarly positive sentiments were reflected in Europe, with indices like the Euro Stoxx 50, Germany’s DAX, and France’s CAC 40 recording gains ranging from 16% to over 20%. However, the UK’s FTSE 100 lagged behind, registering only a 3.78% increase after a challenging 2022.

Economic resilience has been outstanding, showing a remarkable adaptability despite facing significant challenges since 2020. Despite a global pandemic, conflict in Europe, and disruptions in supply chains leading to heightened inflation and a vigorous interest rate-raising cycle, economies worldwide have shown growth trends. By the third quarter of 2023, global gross domestic product had expanded by more than 9% compared to pre-pandemic levels, according to Fitch Ratings’ global aggregate. Businesses have adjusted their logistical setups, Europe has reduced reliance on Russian gas, and contrary to expectations, increased rates did not trigger a notable rise in unemployment. This resilience has also played a significant role in keeping the markets robust throughout the year.

Outside the financial markets, one of the most worrying trends has been the resurgence of conflicts in 2023. The ongoing conflict between Russia and Ukraine, the largest in Europe since 1945, persists. Additionally, Israel’s response to the October 7 terror attacks by Hamas led to an invasion of Gaza. There’s a looming risk of further escalation in the Middle East, potentially involving Israel and Hizbollah in Lebanon.

Chart 1: The Fed Has More Room To Cut Rates Than Other Central Banks.

Source: BCA Research, www.bcaresearch.com

Equities

In 2023, US equities saw significant gains, witnessing the Dow, S&P, and Nasdaq completely reversing their declines from 2022. The Dow achieved a new all-time high, rising by 13.70%, while the S&P nearly reached its January 2022 record close, finishing the year with a remarkable 24.23% increase. The impressive performances by several major tech giants, termed the “Magnificent Seven,” greatly influenced the overall index performance. However, the dominance of a few leading stocks continued to pose a persistent concern throughout the year. Despite a gain of 11.7% in the equal-weight S&P 500, it trailed behind the official S&P 500 index. If not for the last two months, the equal-weight S&P 500 would have remained relatively unchanged (up until October). However, there’s notable variation within the index, with a record-high portion of stocks in the S&P 500 underperforming the index this year. The Nasdaq soared by an impressive 43.42%, yet it still lingers approximately 10% below its all-time high set at the close of 2021.

In 2023, European stocks, after surpassing US stocks in performance in 2022, once again fell behind their American counterparts. Nevertheless, the overall performance remained robust for the year. European equity markets closed the year positively, with the STOXX 600 recording gains of 12.7% for the year. Among the major indices, the DAX increased by 20.3%, the CAC by 16.5%, the FTSE MIB by 28.0%, while the FTSE 100 underperformed with a modest gain of 3.8%. Notably, most EU markets managed to reverse their losses from the previous year, except for the Swiss SMI market, which, after experiencing close to a 17% decline in 2022, only rose by 3.81% in 2023, positioning itself as one of the few underperformers on the continent.

In Asia, the performance was mixed. Japan and South Korea showed gains of over 18% and 28%, respectively, while Chinese and Hong Kong markets struggled, with the Hang Seng down by 13.82% and China’s CSI 300 closing the year with an over 11% loss. This contrasted sharply with the overall strong global market performance in 2023. Additionally, countries like Poland, Hungary, and Mexico experienced index appreciation exceeding 40%, while Thailand and Turkey concluded the year in the red.

Chart 2: US Stocks seem to be expensive. Source: BCA Research, www.bcaresearch.com

Fixed Income

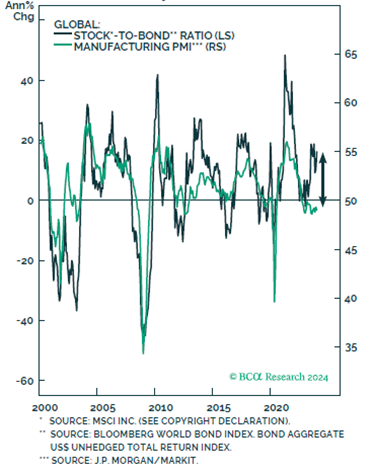

Some analysts think 2024 will be the year of the bond – once again. With rates elevated and cuts on the horizon, fixed income looks ready both for capital appreciation and locking in higher yield. The median forecast in a November survey of more than 50 analysts for Bloomberg predicted that 10-year Treasury yields would fall to 4% by the end of 2024. But yields slipped below that level last month as global stock and bond prices rallied in the wake of the Fed’s mid-December meeting, when chair Jay Powell gave his clearest signal yet that rates would be cut and officials forecast 0.75 percentage points of cuts next year. Yields on benchmark 10-year US Treasuries have declined by almost a percentage point since the end of October and now stands at around 4%. In the case of recession this year, yields are expected to fall under 3.59%, which is the current expected yield by the market participants. This implies that the 10-year Treasury yield has probably overshot to the downside in the short-term, but that government bonds are still a good hedge against recession on the 1-2 year horizon. Hence, we stay overweight on government bonds and underweight on credit.

Chart 3: Global Stock-to-Bond Ratio correlation with PMI’s. Source: BCA Research, www.bcaresearch.com

Commodities and Currencies

In 2023, commodities experienced a challenging period. The Bloomberg Commodities Index (BCOM) dropped by almost 10% during the year, witnessing declines across various sectors including oil, gas, base metals, and grains. Gold, however, stood out with a 13.4% increase, rebounding after two consecutive years of decline and reaching a new record closing high of $2,093.10 per ounce. Oil performed weakly, with WTI crude prices decreasing by 10.7%. Despite geopolitical uncertainties in the Middle East, oil prices received no sustained boost. Concerns persisted regarding China’s slow economic recovery, internal divisions within OPEC+, and the increasing output from non-OPEC nations.

The trajectory of oil in 2023 was particularly intriguing. A year earlier, market analysts had anticipated a surge in international oil prices, projecting the benchmark to rise significantly from around $86 per barrel to surpass $100 in 2023. However, Brent crude futures saw a decline of 10%, closing the year trading at approximately $77 per barrel. Experts caution that any escalation in global instability could potentially push prices higher. The unexpected downturn in oil prices was influenced by actions taken by the Biden administration and US oil companies, leading to an unforeseen surge in petroleum supplies. Concurrently, US oil companies achieved record petroleum production levels during the year, primarily due to improved drilling speeds, longer wells, and enhanced operational efficiency. Analysts generally foresee stable oil prices in 2024, although some warn that unpredictable geopolitical shifts could disrupt this delicate equilibrium.