Investment Outlook November 2023

Global stock markets experienced a turbulent period, with the selling pressure intensifying in the final weeks of October. This was driven by rising yields, increased uncertainty stemming out of the Middle East, and underwhelming corporate earnings. It’s worth noting the resilience of the US economy, considering that very few expected real growths to approach 5% just two months ago, or even a year ago. At the same time, despite the robust growth the Federal Reserve decided to take no action on increasing rates.

Markets have been fluctuating in and out of correction territory despite robust economic growth and solid quarterly earnings in the USA. Investors are now pinning their hopes on a year-end rally, but overall, the prevailing momentum seems to be leaning toward a downward trend. While valuations have moderated somewhat in recent months, providing some explanation, the forecasts for future earnings in the coming quarters are being revised downward. This suggests that valuations might still have room to adjust. Additionally, there is lingering geopolitical uncertainty. While investors have, for the most part, overlooked the turmoil in the Middle East, with only gold acting as a traditional safe-haven asset, there remains a non-negligible possibility of a significant escalation involving multiple countries, which should not be entirely dismissed. Since any kind of market timing is difficult, especially in the wake of recession, which is foreseen in the first half of 2024, staying positioned defensively is the base case. We are leaning towards a low-risk portfolio strategy, with a lower allocation to equities and credit and higher allocation to government bonds.

BENDURA Investment Policy

| very unattraktive | unattraktive | neutral | attraktive | very attraktive | |

|---|---|---|---|---|---|

| g | g | g | g | g | g |

| Liquidity | b | ||||

| g | g | g | g | g | g |

| Fixed Income | b | ||||

| Government | b | ||||

| Corporate | b | ||||

| High Yield | b | ||||

| Emerging Markets | b | ||||

| Duration | b | ||||

| g | g | g | g | g | g |

| Equities | d | ||||

| United States | d | ||||

| Eurozone | d | ||||

| United Kingdom | d | ||||

| Switzerland | d | ||||

| Japan | d | ||||

| Emerging Markets | d | ||||

| g | g | g | g | g | g |

| Foreign Exchange Rates | |||||

| USD | r | ||||

| EUR | r | ||||

| CHF | r | ||||

| EM Currencies | r |

The terms attractive / unattractive describe the return potential of the various asset classes. An asset class is considered attractive if its expected return is above the local cash rate. It is considered unattractive if the expected return is negative. Very attractive / very unattractive denote the highest conviction views of the BENDURA Investment Committee. The time horizon for these views is 3-6 months.

Global Economy

This month, global markets received another shock on the geopolitical front following Hamas’ attack on Israel. While it’s undeniable that this conflict represents a significant humanitarian crisis, capital markets appear to be relatively unfazed. Although there has been a recent market sell-off, it’s challenging to directly attribute it to the situation in the Middle East. Surprisingly, the S&P 500 increased by 1.6%, which was not the typical response expected from a geopolitical shock. Even stock markets in proximity to the conflict, ranging from Saudi Arabia to Egypt and the Gulf states, have experienced only modest pullbacks.

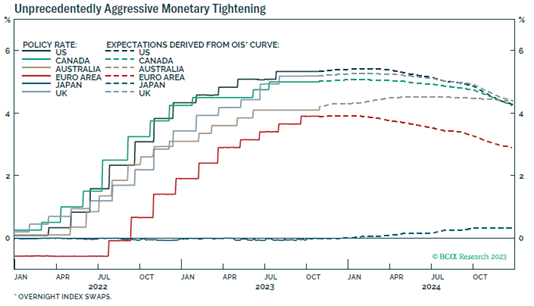

In October, the European Central Bank (ECB) held its policy meeting, where given a greater-than-anticipated easing of inflation and a slowdown in economic activity, the ECB’s decision appeared to be oriented towards minimizing disruptions and postponing critical decisions until the release of the next set of economic forecasts in December. This pause in the interest rate hike cycle, coupled with softer economic indicators, strengthened the belief that the central bank has likely reached the final rate increase. Consequently, attention will now shift to the duration of the restrictive monetary policy. The financial markets are still factoring in the possibility of the first interest rate cut occurring in June 2024. German inflation has declined more rapidly than anticipated, reaching 3 percent, marking its lowest annual rate since June 2021. This decrease in price growth during September was primarily attributed to the first decrease in energy prices since early 2021. Additionally, separate data showed that the German economy contracted in the third quarter. The stagnant economy is contributing to a swift reduction in price pressures, following last year’s notable surge in the cost of living, the most significant in a generation. This situation underscores the rationale behind the European Central Bank’s recent decision to maintain its main interest rate at 4.5 percent after a series of recent rate hikes.

The recent report on US economic growth brought about a significant surprise, as hardly anyone had anticipated a 5% real growth rate. Two key themes emerged from this data: the US consumer’s remarkable resilience and the clear impact of fiscal policy. Real consumer spending increased by 4% year over year, while government spending and investments, especially in research and development (R&D), have consistently contributed to overall GDP for five consecutive quarters. The strength of the third-quarter GDP reading is strong enough that even if growth were to drop to zero in the fourth quarter, the real GDP for the year would still be at 2.3%. Notably, corporate earnings releases align with a robust economy. Although there are pockets of weakness, such as stress among lower-income consumers (evidenced by a multi-decade high in subprime auto loan delinquencies), the private sector’s economic fundamentals are slightly showing signs of possible recession in the foreseeable future.

Chart 1: Aggressive monetary tightening is coming to the end. Source: BCA Research, www.bcaresearch.com

Equities

In recent months, markets have experienced a downturn, with US markets, the DAX, and certain Asian markets now in a correction phase, having dropped more than 10% from their recent peaks. While the economic challenges in Europe can explain the weakness in European markets, even the robust GDP report and strong corporate earnings in the United States haven’t been sufficient to boost investor sentiment. It’s important to note that the relationship between the economy and the stock market isn’t always direct, as other factors come into play, as outlined below.

European stock markets concluded the third consecutive month with losses, and the STOXX 600 index traded at its lowest levels since March. The losses incurred this month have pushed the Stoxx 600 to the brink of wiping out its gains for 2023, marking a potential technical correction. This departure from the historical pattern of positive October returns over the past 25 years raises doubts about the possibility of a year-end rally. While technical indicators and market positioning offer some support, they are not yet robust enough to counteract the prevailing macroeconomic and geopolitical challenges.

In October, US equities faced a decline, with both the S&P and Nasdaq sliding more than 10% from their July peaks, pushing them into correction territory. While major tech stocks saw decreases, they still contributed to the official S&P’s outperformance compared to its equal-weight counterpart, RSP, which ended the month with a 4.1% drop. The S&P 500 marked its third consecutive monthly decline, the longest losing streak since March 2020, concluding the month with a 2.2% decrease. This three-month decline in stocks coincided with a three-month halt in interest rate increases, the lengthiest pause since the Federal Reserve began raising borrowing costs. On the other hand, small caps, as represented by the Russell 2000, had a tough month, falling by 6.88%, and are now in negative territory for the year. The Russell 2000 includes more US-centric companies, which may suggest that investors are becoming concerned about the US economy, despite the recent strong GDP figures. The equal-weighted S&P 500 is now firmly in negative territory for the year after experiencing a 4% loss in October.

As for the “Magnificent 7,” which are a significant factor in the S&P 500’s positive performance for the year, some of the major tech stocks, despite a recent pullback, still appear relatively expensive compared to historical norms. For instance, Microsoft is trading at 28 times its projected earnings for the next 12 months, exceeding its 10-year average of about 23. Apple’s price reflects approximately 25 times future earnings, compared to its historical average multiple of nearly 19. In contrast, the S&P 500 carries a multiple of 18 times.

For investors, the current landscape suggests maintaining a cautious stance. It’s not yet the time to become overly bullish, rather it is better to focus on high-quality companies in the European, Japanese and U.S. markets with strong operational leverage and solid balance sheets.

Fixed Income

The ongoing instability in bond markets and an increase in geopolitical tensions had a negative impact on risk appetite. The conflict between Israel and Hamas in the Middle East further contributed to this pessimistic sentiment. Additionally, the continuous rise in Treasury yields was a significant concern for investors and acted as a headwind for equities. Market participants were still adjusting to the idea of a Federal Reserve that is likely to maintain higher interest rates for an extended period, despite the ongoing positive economic surprises. The yield on 10-year Treasury notes surpassed 5% in October, the first time since 2007. While not historically high, it represents a significant shift from the levels of less than 1% observed for most of 2020. The German Bund briefly reached the 3% level but closed the month 3 basis points lower at 2.8%. The spread between the Bund and Italian BTP bonds briefly exceeded 200 basis points due to focus on Italy’s 2024 budget. UK 10-year Gilts rose by 7 basis points to 4.51%, with the Bank of England expected to keep rates at elevated levels until at least June 2024.

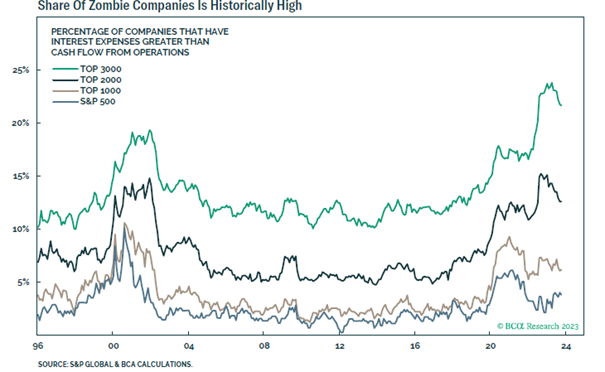

There were also concerning signals from the credit market, with credit spreads showing some warnings, especially the most vulnerable high-risk bonds, with this group experiencing its worst month in over a year due to disappointing earnings results and growing fears regarding defaults and bankruptcies. The number of so-called ¨Zombie Companies¨ (those with interest expenses greater than their cash flow from operations) has soared, especially between small-cap stocks. Delinquencies have already risen strongly in the sector of commercial real estate, auto loans and credit cards.

Therefore, we do not change our stance in fixed income area. We suggest underweighting the credit due to rising defaults caused by higher interest rates and prefer government bonds as a good hedge against recession risks and a little downside given the fact that interest rates are nearing their cycle-peak.

Chart 2: The rising number of Zombie Companies. Source: BCA Research, www.bcaresearch.com

Commodities and Currencies

Gold has experienced a massive 7% rebound from its high-volume level at 1800$ and is now traded close to 2000$. Oil continues to be driven largely by supply considerations. Saudia Arabia and Russia have cut production in recent quarters to bolster the price.

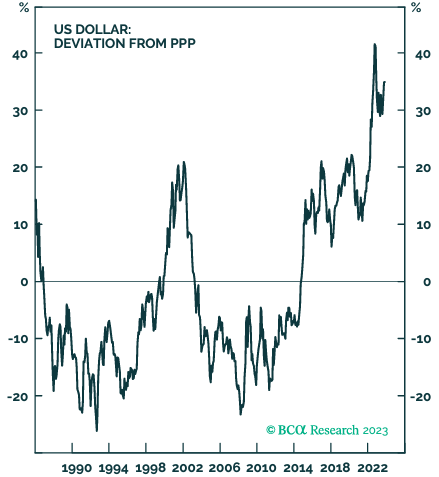

On the currencies side, we see a strength in the USD for the next weeks. The dollar is a counter-cyclical currency since the US economy tends to be more resilient during global recessions – exactly as it has proved to be this year. Emerging Market currencies remain vulnerable to a global slowdown and further depreciation in the RMB. But we see some Potential on the Yen. The Bank of Japan has adjusted its Yield Curve Control again and will scrap in the not-to-distance future.

Chart 3: The US Dollar remains very overvalued. Source: BCA Research, www.bcaresearch.com