INVESTMENT OUTLOOK MARCH 2024

Equity markets maintained upwards trajectory throughout February, with multiple indices achieving new record highs. The S&P 500 had already hit a new high in the previous month and surged past the 5,000-point mark again in February, driven by NVDA’s exceptional earnings announcement. This boost resonated globally, as with the STOXX 600 in Europe setting the record on the same day. Even before NVDA’s announcement, Japan’s Nikkei 225 had surpassed its previous peak from 1989. Additionally, the MSCI World index reached an all-time high in February, undeterred by higher-than-expected inflation figures for January. Notably, this time market’s rally is not solely reliant on the technology sector, with all sectors in the US posting gains since October last year.

Looking ahead, the key question for the market in the near term is whether it can sustain its upward trajectory despite potential delays in rate cuts, with a full cut now being priced in for July in the US, a significant shift from earlier expectations. However, this delayed timeline for rate cuts could provide some support for markets if disinflation accelerates in the coming months. Signs of market exuberance are emerging, and a pullback after major stock indexes repeatedly hitting record highs should be welcomed. Therefore, since any kind of market timing is difficult, staying positioned defensively is the base case. We are leaning towards a low-risk portfolio strategy, with an underweight allocation to equities and credit and higher allocation to government bonds.

BENDURA Investment Policy

| very unattraktive | unattraktive | neutral | attraktive | very attraktive | |

|---|---|---|---|---|---|

| g | g | g | g | g | g |

| Liquidity | b | ||||

| g | g | g | g | g | g |

| Fixed Income | b | ||||

| Government | b | ||||

| Corporate | b | ||||

| High Yield | b | ||||

| Emerging Markets | b | ||||

| Duration | b | ||||

| g | g | g | g | g | g |

| Equities | d | ||||

| United States | d | ||||

| Eurozone | d | ||||

| United Kingdom | d | ||||

| Switzerland | d | ||||

| Japan | d | ||||

| Emerging Markets | d | ||||

| g | g | g | g | g | g |

| Foreign Exchange Rates | |||||

| USD | r | ||||

| EUR | r | ||||

| CHF | r | ||||

| EM Currencies | r |

The terms attractive / unattractive describe the return potential of the various asset classes. An asset class is considered attractive if its expected return is above the local cash rate. It is considered unattractive if the expected return is negative. Very attractive / very unattractive denote the highest conviction views of the BENDURA Investment Committee. The time horizon for these views is 3-6 months.

Global Economy

Overall, the macroeconomic landscape has undergone some changes since January, with inflation declining at a slower pace than anticipated and the labor market showing resilience. Additionally, Fed Chair Jay Powell’s remarks have indicated a patient approach to any potential rate cuts, further influencing market sentiment and expectations. The US economy still looks solid: It grew by 3.1% last year, and the Atlanta Fed Nowcast suggests 3.0% annualized GDP growth in Q1 2024. But that growth has mostly been driven by consumption, fueled by excess household savings, which are close to running out.

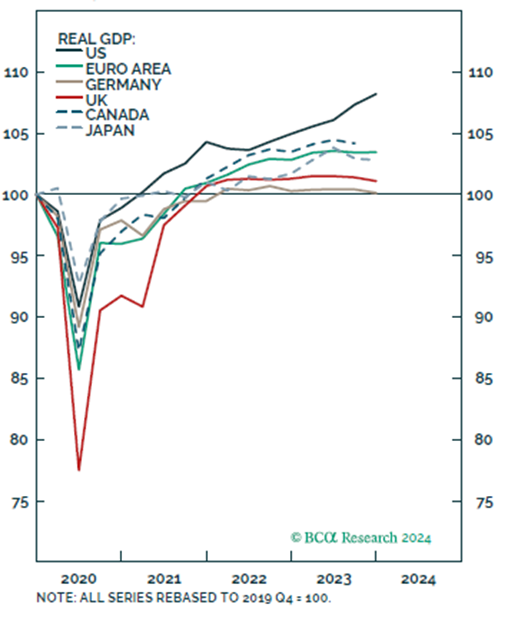

Germany is in a state of near-recession, but the same is not true for the rest of the Eurozone. Therefore, Germany will likely drag the overall Euro Area into contraction, even if, individually, other countries manage to avoid a recession and continue to grow at a near-stagnation pace.

China’s economy is currently at a critical juncture, facing significant challenges stemming from its outdated economic model heavily reliant on infrastructure and real estate investment. This model, which once fueled rapid growth, is now showing signs of strain, with growth slowing and prices declining. The real estate sector, which traditionally contributed around a quarter of China’s annual economic output, has experienced a sharp downturn since 2020, exacerbating economic concerns. This decline has dampened consumer optimism and contributed to deflationary pressures, a stark contrast to the inflationary trends observed in other parts of the world in recent years. Beyond these immediate economic challenges, China is also grappling with longer-term demographic issues that pose serious threats to its future stability and growth. The country’s demographic landscape is rapidly changing, with a significant decline in births and an aging population. This demographic shift, occurring earlier in China’s development trajectory than in other major economies, has been accelerated by factors such as the one-child policy. The resulting decrease in births and increase in elderly citizens not only threatens to impede economic growth but also presents challenges for sustaining social welfare systems.

Chart 1: Except from US, the global growth has stalled. Source: BCA Research, www.bcaresearch.com

Equities

February demonstrated robust performance across global equity markets, with only the UK’s FTSE 100 ending marginally in the red. Notably, Chinese equities experienced an uptick, with the Hang Seng and CSI 300 rallying significantly. Japan’s Nikkei 225 also continued its upward trajectory, contributing to an impressive year-to-date gain. In the US, all three major indices closed positively, with the S&P 500 and Nasdaq registering substantial gains. Similarly, European markets delivered strong performances, with indices such as the DAX, CAC, and FTSE MIB posting gains ranging from 3.5% to 6% for the month.

European equity markets continued their upward trend for the fourth consecutive month in February, with the STOXX 600 reaching a new all-time high of 497.75 on February 23rd before retracing slightly. Like the previous month, the FTSE 100 lagged behind due to its exposure to miners and energy sectors, while leading real estate stocks faced pressure amid concerns about debt refinancing.

Similar to the US’s “Magnificent 7” stocks, Europe also has its market-dominating companies known as the “Granolas.” These include pharmaceutical companies GSK, Roche, and Novartis, chip company ASML, Nestlé, Novo Nordisk, L’Oréal, LVMH, AstraZeneca, SAP, and Sanofi. While the Granolas have contributed significantly to gains in the Stoxx Europe 600 index and have been involved in numerous mergers, their combined market capitalization of around $3 trillion is smaller compared to their US counterparts. Despite this, the Granolas trade at a lower earnings multiple compared to the Magnificent Seven, indicating potential value opportunities for investors.

In India, while large-cap stocks have seen gains, medium and small-cap companies have experienced even greater growth. This trend reflects the growing adoption of equity investment among a broader swath of the population, buoyed by rising incomes. Notably, a significant number of companies in India have seen their value triple over the past decade, with many now boasting market capitalizations exceeding $1 billion. However, investing in India does come with its own set of risks, including higher valuations compared to its American counterpart. Nevertheless, the market exhibits lower volatility, indicating a robust confidence among investors in the sustainability of its growth trajectory.

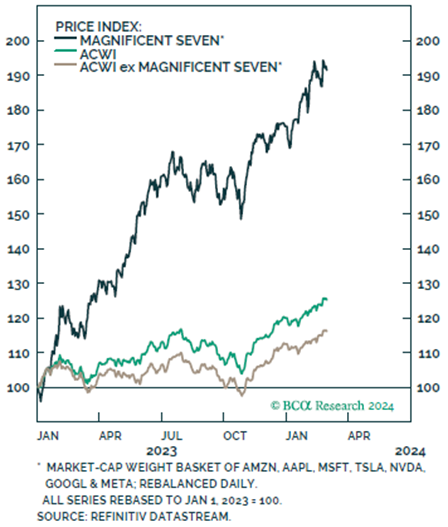

Chart 2: Performance of the Magnificent 7 in comparison to ACWI Index. BCA Research, www.bcaresearch.com

Fixed Income

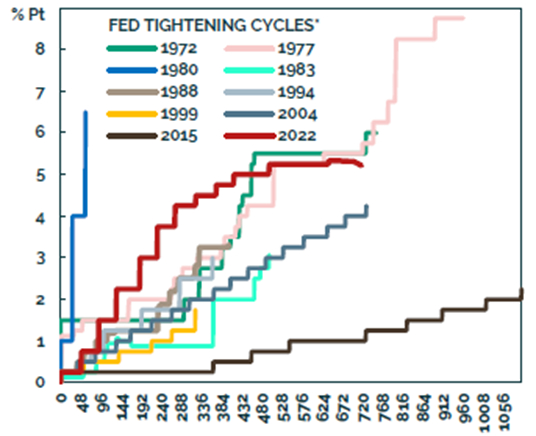

Yields have been rising in the last months – to 4.3% from 3.8% for the US 10-year, as the market was pricing out aggressive Fed cuts this year. As the economy is still strong and inflation remains sticky, potential delays in rate cuts are being priced in. So far rate cuts were delayed until summer, with a full cut now being priced in for July. As of now, the market expects over 3 cuts this year.

Even though the US economy remains strong, the weakness in Germany’s economy will allow the ECB to cut rates more aggressively than the Fed will, especially as European wages show early signs of a deceleration. Meanwhile, the recent backup in German yields to 2.4% seems to be overdone. Thus, even if the Eurozone economy outside of Germany dodges a recession in 2024, the market participants expect four rate cuts this year.

Chart 3: FED tightening cycles in the past. BCA Research, www.bcaresearch.com

Commodities and Currencies

Less positive economic data in the US helped to spark a rally in the gold prices in the last weeks, topping the previous high set in December. However, many were not expecting the price appreciation with such speed and scale since there was the absence of any significant changes in the outlook for when the Federal Reserve would start cutting rates. Additionally, the Chinese central bank increased its gold reserves for the 16th time in a row in January, continuing a sustained buying spree. Gold typically has an inverse relationship with bond yields but has been supported by strong central bank buying and demand from consumers in China in particular. As of now, the highest price of gold recently was USD 2164 per Troy ounce.

In the field of cryptocurrencies, February was a stellar month for most of them. Bitcoin, the biggest currency by market capitalization, has reached the historical highs at USD 69’200 following acceptance of Bitcoin’s exchange traded funds (ETFs). Another strong rally of the second most valuable currency Ethereum (ETH) sent the currency 116% up this year at the end of February. Even though Ethereum did not reach all-time highs in the past weeks, the optimism regarding acceptance of Ethereum ETFs still shows potential upside for the currency.