Investment Outlook August 2023

In July, the idea of a soft landing in the US economy regained prominence, as inflation, unemployment, and growth aligned favorably to propel equities higher.

In July, the idea of a soft landing in the US economy regained prominence, as inflation, unemployment, and growth aligned favorably to propel equities higher. Indices like the S&P 500, Nasdaq, Dow, MSCI World, France CAC, and Europe’s Euro Stoxx 50 have all returned to bull market territory (greater than 20% from their lows) after reaching their lowest points around October 22, despite high levels of pessimism during that time. However, historical precedent shows that the kind of vigorous monetary tightening seen last year ultimately leads to a slowdown in the economy and a subsequent recession. Current leading indicators unmistakably signal this impending outcome. With equity exposure currently at historically high levels and the upcoming weaker seasonal performance (historically, September and August have been the S&P 500’s worst months), a period of decline could be on the horizon. Even in the absence of recession concerns, equities would lack attractiveness, given that they currently possess the highest valuation compared to bonds since 2002, and investor sentiment has turned optimistic once more.

Our message to the readers would be staying careful with the bull-run going forward, which has already surprised many professional investors. Therefore, over the next 12 months horizon, we still observe substantial risks weighted heavily towards the downside. We tend to opt for a low-risk portfolio strategy, including a reduced allocation to equities and credit, an increased allocation to government bonds, and maintaining a benchmark weight in cash.

BENDURA Investment Policy

| very unattraktive | unattraktive | neutral | attraktive | very attraktive | |

|---|---|---|---|---|---|

| g | g | g | g | g | g |

| Liquidity | b | ||||

| g | g | g | g | g | g |

| Fixed Income | b | ||||

| Government | b | ||||

| Corporate | b | ||||

| High Yield | b | ||||

| Emerging Markets | b | ||||

| Duration | b | ||||

| g | g | g | g | g | g |

| Equities | d | ||||

| United States | d | ||||

| Eurozone | d | ||||

| United Kingdom | d | ||||

| Switzerland | d | ||||

| Japan | d | ||||

| Emerging Markets | d | ||||

| g | g | g | g | g | g |

| Foreign Exchange Rates | |||||

| USD | r | ||||

| EUR | r | ||||

| CHF | r | ||||

| EM Currencies | r |

The terms attractive / unattractive describe the return potential of the various asset classes. An asset class is considered attractive if its expected return is above the local cash rate. It is considered unattractive if the expected return is negative. Very attractive / very unattractive denote the highest conviction views of the BENDURA Investment Committee. The time horizon for these views is 3-6 months.

Global Economy

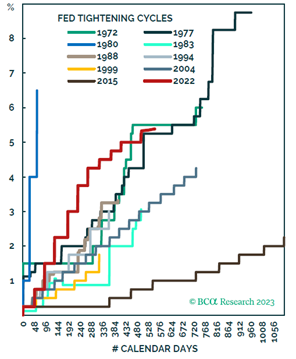

Central banks worldwide have implemented strict monetary policy tightening measures. The Federal Reserve, for instance, has increased interest rates by 525 basis points within a mere 16-month period, constituting one of the most rapid tightening sequences in historical context. All significant central banks have pushed rates significantly above the neutral level. It’s worth noting that over the last five decades, merely two tightening cycles by the Federal Reserve concluded without leading to a recession (in 1983 and 1994), both instances involving rate hikes of only 300 basis points.

Despite the implementation of tighter policies, the economic growth in the United States has demonstrated its durability. Several factors contribute to this phenomenon. In the initial stages of the pandemic, businesses secured significant borrowing, supported by the interventions of the Federal Reserve and the European Central Bank in underwriting debt issuance. Consequently, their susceptibility to escalating borrowing expenses has diminished. Households still retain a substantial surplus of approximately $1 trillion in savings, a reserve that has been reinforced by the recent increase in real wages, attributed to the more rapid decline of inflation relative to income. Within the United States, the majority of mortgages, about 70%, possess a fixed rate spanning 30 years, while an additional 19% are locked in fixed rates for 10 years or more.

Economic expansion in other global regions, especially within the manufacturing sector, appears notably less robust compared to the United States. New orders for manufacturing in the Euro area have declined to levels below 40, and presently, the momentum in services growth also seems to be waning. Lending conditions have been significantly tightened by bank loan officers, indicating an anticipated deceleration in loan growth. Initial indicators are beginning to manifest a softening in the US labor market as well: there has been a reduction in the number of hours worked, which is untypical occurrence during an expansionary phase, and the duration of unemployment has started to exhibit an upward trend. However, the long and variable lags of monetary policy still loom over the market. We likely have yet to see most of the impact of the aggressive Fed tightening.

One of the fastest FED hiking cycles in history. Source: BCA Research, www.bcaresearch.com

Equities

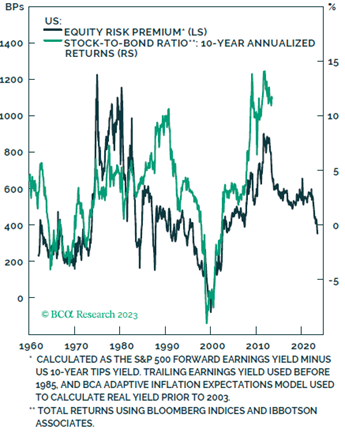

The confidence within the stock market appears significantly elevated, indicating an increased likelihood of a gradual economic slowdown. Over the past few weeks, the rally boosted by AI-driven trading, which initially influenced only a limited selection of stocks, has extended its reach to encompass other segments of the market, resulting in their rise. Notably, the performance of the equally weighted S&P index is now surpassing that of the market capitalization-weighted S&P 500 index. Nonetheless, this contrasts with the bond market’s stance, as the yield curve continues to exhibit a substantial inversion, strongly hinting at an impending recession.

In general, there was an impressive run across worldwide equity markets in July. The Hang Seng emerged as the top-performing equity index, achieving an impressive 6.15% gain, trailed by China’s CSI 300 and the Nasdaq, which advanced by around 4.48% and 4.05%, respectively. In the Asian region, Chinese stocks achieved their most substantial monthly increase since January, driven by a sequence of subdued data indicators that led to an optimism about potential economic stimulus measures from officials and policymakers. These measures are aimed at boosting growth and preventing the risk of falling into a state of deflation. Even if China were to unveil stimulus measures, we raise doubts about their potential effectiveness, as the country might find itself tangled in a situation characterized as a “liquidity trap”.

Equity risk premium is lowest since 2002. Source: BCA Research, www.bcaresearch.com

Fixed Income

Positive sentiment regarding the probability of soft landing has taken place in the debt markets, as seen by the fast reduction in the additional cost that high-risk corporate borrowers incur when issuing new debt. The difference between yields on lower-rated US corporate bonds and comparable Treasury securities has contracted by nearly 0.9 percentage points since the start of June, marking one of the most substantial two-month declines observed since 2020.

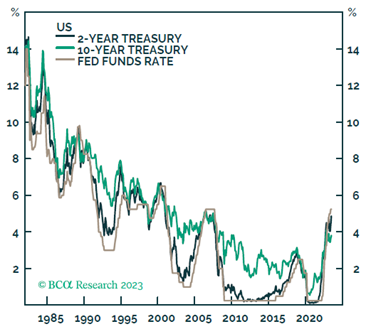

Our perspective remains that government bonds offer the most effective safeguard against a recession. A pattern often observed is that US Treasury yields tend to stabilize within a certain range once the Federal Reserve concludes its rate hikes, and a notable decline in yields usually occurs only when the Fed initiates rate cuts. Consequently, a substantial decline in yields would likely require an increase in unemployment beyond the 4% level, prompting a Fed rate cut. However, the potential return scenarios for 10-year Treasurys exhibit a distinct asymmetry: They could yield zero returns if yields climb to 4.5% yet offer returns of up to 20% if yields drop to the range of 1.5% to 2% during a recession.

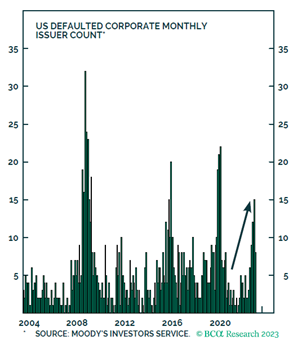

We remain cautious on credit. Cases of defaults have begun to increase. However, US High-Yield market is too optimistic about the outlook. US high-yield bonds are currently factoring in only a marginal rise of default rates within the upcoming 12-month period.

Number of defaulted companies in US. Source: BCA Research, www.bcaresearch.com

US-interest rate 2 & 10 year government bonds. Source: BCA Research, www.bcaresearch.com

Commodities and Currencies

As always, the prospects for commodities are closely linked to the situation in China. The recovery trajectory of China post-Covid has been less than satisfactory, raising concerns about the vulnerability of the government’s modest 5% GDP growth target for the current year. Even though the prospects of China’s stimulus are mixed, Chinese oil demand is boosting prices, with WTI +16.1% in July, posting its best month since January 2022 and settling back above $80/barrel.

We remain neutral on the USD currency, as it seems 30% overvalued versus Purchasing Power Parity even after 10% climb since October 2022. However, it’s important to note that the dollar tends to move in the opposite direction of the economic cycle, appreciating during times of recession. Notably, the dollar has exhibited recent weakness against the euro, even though Europe’s economic conditions are notably poorer compared to those in the United States.

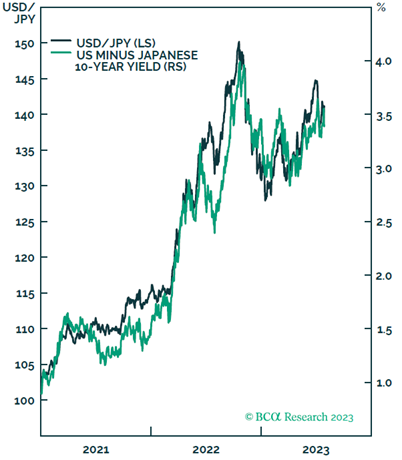

Our position continues to favor the yen. The recent adjustment made by the Bank of Japan to its yield curve control strategy, essentially modifying the upper limit for the 10-year Japanese Government Bond (JGB) yield from 50 basis points to a range spanning 50-100 basis points, indicates a potential for more substantial downward movement in US Treasury yields compared to JGB yields, particularly in the context of an economic recession. This dynamic is likely to have a positive impact on the yen’s performance, especially considering that the yen is currently undervalued.

Yen should be helped by rate differentials. Source: BCA Research, www.bcaresearch.com