Investment Outlook September 2023

The late-August rally fell short of bringing major indexes into positive territory for the month. August marked the poorest performance for global equities in approximately eight months, as markets grappled with concerns related to China and a continuous uptick in interest rates, which eventually reversed in the closing days of August. On one hand, mounting evidence of China’s economic slowdown, coupled with its struggles to recover from pandemic-related lockdowns and apprehensions regarding its extensive real estate sector, made investors uneasy. On the other hand, a series of strong US economic indicators compelled investors to reconsider their outlook on inflation and interest rates. While inflation appeared to be moderating, rising yields put pressure on equity valuations. Notably, US TIPS (Treasury Inflation-Protected Securities) reached a 14-year high. Additionally, two events worth mentioning are NVIDIA’s earnings report and the Jackson Hole Symposium. Despite NVIDIA reporting exceptional earnings, and Federal Reserve Chair Jerome Powell delivering a speech at Jackson Hole that presented various perspectives, the market failed to advance, indicating that much of the positive news may already be factored into current valuations. Looking ahead, investor optimism is likely to face a significant challenge, as historical data suggests that September has consistently been the worst-performing month for stocks, with the S&P 500 recording an average loss of 1.1% dating back to 1928.

This month we reiterate our message to the readers: stay careful with the bull-run going forward. As a result, we continue to see significant risks heavily weighted to the downside over the next 12 months. We are leaning towards a low-risk portfolio strategy, with a lower allocation to equities and credit, a higher allocation to government bonds, and maintaining a benchmark weighting in cash.

BENDURA Investment Policy

| very unattraktive | unattraktive | neutral | attraktive | very attraktive | |

|---|---|---|---|---|---|

| g | g | g | g | g | g |

| Liquidity | b | ||||

| g | g | g | g | g | g |

| Fixed Income | b | ||||

| Government | b | ||||

| Corporate | b | ||||

| High Yield | b | ||||

| Emerging Markets | b | ||||

| Duration | b | ||||

| g | g | g | g | g | g |

| Equities | d | ||||

| United States | d | ||||

| Eurozone | d | ||||

| United Kingdom | d | ||||

| Switzerland | d | ||||

| Japan | d | ||||

| Emerging Markets | d | ||||

| g | g | g | g | g | g |

| Foreign Exchange Rates | |||||

| USD | r | ||||

| EUR | r | ||||

| CHF | r | ||||

| EM Currencies | r |

The terms attractive / unattractive describe the return potential of the various asset classes. An asset class is considered attractive if its expected return is above the local cash rate. It is considered unattractive if the expected return is negative. Very attractive / very unattractive denote the highest conviction views of the BENDURA Investment Committee. The time horizon for these views is 3-6 months.

Global Economy

The picture in different regions of the world is contrasting, transitioning from a robust economy in the United States to a less-than-healthy one in China. Economic data emerging from China has taken a progressively negative turn, with authorities even deciding to cease the publication of certain data points (such as youth unemployment). Presently, the most pressing issue in the realm of global macroeconomics revolves around whether China is on the verge of a “balance sheet recession” – an extended period marked by deflation, economic lethargy, declines in the property market, and financial strain as households, businesses, and governments grapple unsuccessfully with deleveraging following a period of excessive debt accumulation.

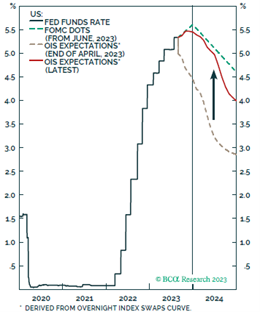

Market participants have observed that central banks remain nervous regarding inflation, thus rate should stay higher for longer. Therefore, inflation pressures remain at place: wage growth in the US remains high, oil prices have recovered up to $88 per barrel, healthcare prices increasing and housing market is also rebounding. Due to all these factors, central banks are reluctant to lower interest rates until they see a sharp decline in economic activity or employment. While the number of job vacancies is declining, the vacancy rate is likely to continue to fall until the unemployment rate rises significantly.

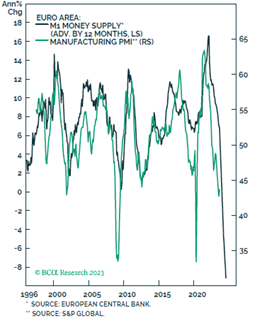

And the rest of the world looks much weaker than the US. Money supply is contracting in Europe, which points to a further slowdown in activity. Economic activity in the euro zone fell far more than expected in August, with a particularly sharp decline in Germany, while some inflationary pressures returned, surveys showed. The purchasing managers’ indexes complicate the situation for the European Central Bank, which is seeking to control the still unbridled rise in prices without triggering a recession. A further rise in rates by year-end remains on the cards, however, it will be data dependent.

The market has changed its mound about. FED Cuts. Source: BCA Research, www.bcaresearch.com

Tight policy is starting to bite in Europe. Source: BCA Research, www.bcaresearch.com

Equities

US stock markets closed mostly in the red. The S&P 500 and the Nasdaq indices experienced their first monthly decline since February, with the S&P 500 down around 1.77% and the Nasdaq technology index down 2.17%. August’s declines were broad, though shallow. These included large banks, automakers and technology companies, while energy stocks were the only part of the S&P 500 with a positive monthly gain. The negative factors in August included warnings of a bank credit downgrade, further tightening of bank lending standards and a decline in loan demand. Despite the downturn, there were a number of positive developments, notably the continued trend toward disinflation and the positive momentum of macroeconomic surprises, which further reinforced expectations of a soft landing. It should be noted that US markets remain firmly in the green this year, with the Nasdaq still up more than 30% and the S&P 500 up almost 17% as of mid- September.

The outlook for European stock markets remained negative. A survey of stock market strategists and fund managers, as well as sales surveys, showed that most of them expect a slowdown in global economic growth to offset the attractively valued European stock market by the end of 2023. All major European indices declined in August, with the FTSE 100 and the DAX suffering significant losses of 3.38% and 3.04% respectively. The Swiss SMI, given its rather defensive position, suffered smaller losses and ended the month down 1.62%. The biggest negative impact on the region’s equity markets was in China (Hang Seng Index -4,4%), where economic activity has slowed down and the problems of property developers are still threatening the financial instability.

Therefore, we continue to recommend a low-risk portfolio, with underweights on equities. Timing the market top with risks leaning towards upcoming recession could be problematic.

Fixed Income

In the USA, treasuries experienced mostly weaker performance, resulting in a steepening of the yield curve. However, yields ended the month significantly lower than their peak levels, thanks to a late-month relief. At one point, these yields had climbed as high as 4.34%, marking their highest level since the period preceding the Global Financial Crisis. Several factors contributed to this upward movement in bond yields, including a reassessment of Federal Reserve policy expectations due to a more favorable U.S. economic growth outlook, increased scrutiny of budget deficits following the Fitch downgrade, pressures related to the supply of bonds, discussions about the peak of disinflation, and adjustments made to the Bank of Japan’s Yield Curve Control (YCC) policy.

In Europe, bond markets also experienced significant volatility as central banks approach the conclusion of their interest rate cycles. Initially, bond yields increased at the start of the month in response to shifts in interest rate expectations. Moreover, now that market expectations of interest rates moves have been repriced upwards, there is limited probability of a hawkish surprise. This suggests there is little downside risk in Government Bonds and creates a good entry point – unless inflation rebounds, the central banks turn out to be more hawkish than expected, or real growth accelerates.

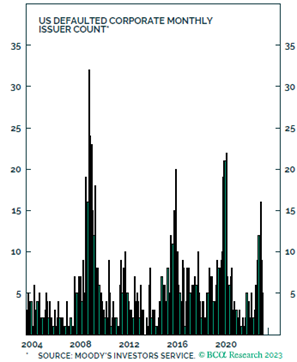

In fixed income area we tend to underweight the credit due to rising defaults caused by higher interest rates. However, we prefer government bonds as a good hedge against recession risks and a little downside given the fact that interest rates are nearing their cycle-peak.

Number of defaulted companies in US. Source: BCA Research, www.bcaresearch.com

Commodities and Currencies

Although Chinese economy faces growth challenges, the CRB Raw Industrials Commodity Index rose 1% last month. However, a long-term loss of Chinese growth momentum would have a very negative impact on the outlook for metals, especially considering how large the Chinese share of global demand is. A similar scenario is seen for oil demand, however current production declines in Russia and Saudi Arabia continue to drive oil prices higher.

The mood on the grain markets is also subdued. Wheat continues its bearish trend despite the Ukraine conflict. European wheat futures, which are traded in Paris, have reached further lows for 2023 at the start of the week with prices around 216€. As the largest exporter, Russia is price-determining in the wheat market. In the US, unfavorable weather conditions are currently providing some price support for corn and soybean futures.

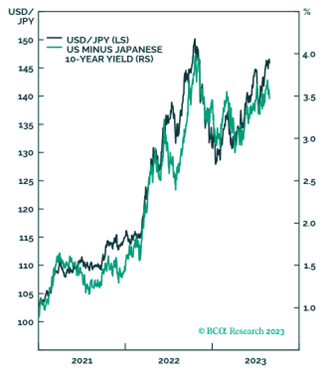

On the currencies side, we remain neutral on USD and currently see a recovery against EUR and CHF. However, inflation in the US is easing, which could put some downward pressure on the dollar again. Currently, the Japanese yen can be seen as a safe haven, due to the simple fact that Japanese bonds will fall much less in a recession than elsewhere. In emerging currencies, we see vulnerabilities if the Chinese government continues to allow the Renmimbi to weaken.

Japanese Yen would fall less in a recession, helping JPY. Source: BCA Research, www.bcaresearch.com